Restoring Markets. Reimagining Possibilities.

From small towns to middle markets and urban centers—Reinvestment Fund’s smart data and capital solutions are creating new pathways to opportunity in our nation’s low-income communities.

Impact Investments

In 2016, we made $134 million in investments that benefit low-income communities.

Creative placemaking

Reinvestment Fund has been targeting high-impact arts investments in Central Baltimore, which is also home to the Station North Arts and Culture District.

After nearly a decade of vacancy, the Centre Theater was renovated to house a joint film program by Johns Hopkins University and Maryland Institute College of Art as well as office space. Reinvestment Fund supported the transformation of the historic building from an early stage, providing Jubilee Baltimore, the nonprofit developer and owner of the theater, with financing for predevelopment. Across the street, the historic Parkway Theater had long sat vacant. Reinvestment Fund financing rehabilitated the theater and adjacent buildings to create a world-class center for film, filmmakers and film education.

Reinvestment Fund also received a $3 million investment from The Kresge Foundation for creative placemaking efforts in Baltimore, Atlanta and New Orleans.

Investments in clean energy

Environmentally responsible development is embedded in Reinvestment Fund’s mission, as low-wealth people and places disproportionately bear the risks and costs of climate change. This commitment has resulted in $102 million in clean energy investments.

For example, we supported a portfolio of residential solar projects in Connecticut, and our investments in Ecosave are helping upgrade building efficiency—a sector that, according to the U.S. Energy Information Administration, accounted for 41% of U.S. energy consumption in 2014. Our investment includes the headquarters of an association of nonprofits providing services to America’s seniors, which will be 25% more efficient. We are also supporting Pennsylvania’s first ever community solar project located in the Philadelphia Navy Yard. The electricity generated by the project will increase the share of the Navy Yard powered by clean energy.

Social impact investing through Pay for Success

Reinvestment Fund helped finance two Pay for Success projects in 2016. In Utah, the Homes Not Jail program provides services to improve housing stability and criminal justice and behavioral health outcomes for the persistently homeless in Salt Lake County.

In Connecticut, we supported the state’s first Pay for Success project that is tackling child abuse and neglect through in-home, attachment-based parent-child therapy and substance abuse treatment. The project will scale prior efforts and help 500 new families with young children receive these needed services to help ensure family stability and keep young children with their parents.

Our participation in these projects builds on decades of experience financing affordable housing and community services. Reinvestment Fund also has expertise in housing policy issues and analyzing inequities related to low-income and vulnerable populations.

Support for quality K-12 education

Reinvestment Fund has invested more than $460 million in K-12 schools that enroll more than 51,520 students from low-income communities.

Reinvestment Fund financing is helping Keystone Academy Charter School, a high-performing K-8 school in Philadelphia whose program uses a concentrated science and mathematics curriculum, including the use of integrated technology. In Washington, D.C., we supported two early stage public charter schools that will share facilities at the former St. Paul’s College, which also has space reserved for workforce affordable housing for teachers. And in Newark, NJ, with the help of New Markets Tax Credits, Reinvestment Fund is helping Great Oaks Charter School, a member of the AmeriCorps National Service Network, acquire and renovate its urban campus.

Thanks to grant funds from the U.S. Department of Education Credit Enhancement for Charter School Facilities Program, Reinvestment Fund can provide more flexible loan terms to some of our schools.

Enhancing capacity

We enable our partners, policymakers, borrowers and peers to grow their capacity and their impact.

Access to fresh, healthy food for all

“Most people think of rural towns as farm towns—and there’s plenty of food in a town with farms around it, right? That’s really just not the case.”

Reinvestment Fund is honored to have been selected as the National Fund Manager for the USDA’s Healthy Food Financing Initiative (HFFI). We are eager to lead this national effort to invest in healthy food access, an economic engine in communities that helps create much-needed jobs and spur small business growth. As the National Fund Manager, Reinvestment Fund is committed to building a more equitable food system that supports the health and economic vibrancy of all Americans—including rural communities, food systems entrepreneurs, and communities of color.

Equitable development in Atlanta

The Atlanta metro is one of the fastest growing regions in the United States, but it also leads the nation in income inequality.

Reinvestment Fund is partnering with Atlanta Neighborhood Development Partnership (ANDP) and Access to Capital for Entrepreneurs (ACE) to promote equitable development that will include low-income and minority communities in the growing prosperity of the region. Supported by a grant from JPMorgan Chase’s PRO Neighborhoods, the Equity Atlanta Collaborative is coordinating efforts, pooling resources, developing a data-driven investment strategy, and strategically aligning its investments. For example, Reinvestment Fund and ANDP recently financed the Sheltering Arms early childhood education and family center in Peoplestown, which is among the city’s most persistently distressed neighborhoods where 45% of families live in poverty. The new Sheltering Arms center will serve 200 children.

Strengthening mid-sized cities

From Portland, ME, to Riverside, CA, from Flint, MI, to Gulfport, MS, cross-sector teams from 50 cities gathered in Philadelphia in the summer of 2016 to launch the Invest Health learning community.

Teams brought a great depth of experience and knowledge, along with diversity of perspectives. They laid the foundation for their work over 18 months to improve opportunities for low-income communities through food access, public safety, housing, employment, and more.

Since then, teams have met at two national convenings and smaller issue-focused pods to share learnings and refine their strategies.

“Your zip code is a better predictor of your health status than your genetic code. That isn't a cute line, it's the truth. Therefore, we need to be partnering with people that are in the zip code improvement business—and that’s you.”

Opportunity and instability in Philly housing markets

A Reinvestment Fund and May 8 Consulting study demonstrated the value of a “scattered site” approach to affordable housing development (as compared to constructing apartment buildings or multi-unit townhomes).

The study focused on developments by West Philadelphia Real Estate and Neighborhood Restorations, two long-time Reinvestment Fund borrowers. Our case study found that scattered site was more cost effective—it required limited public subsidy and fewer tax credits—and under certain circumstances, it has twice the impact on surrounding home sale values.

And inspired by Matthew Desmond’s book, “Evicted: Poverty and Profit in the American City,” Reinvestment Fund quantified and mapped the geography of evictions in Philadelphia. We were shocked to learn that eviction rates among renter households have consistently exceeded 7% over the last six years, which is four to five times greater than foreclosure filing rates over the same period. Even controlling for income and poverty, evictions are disproportionately higher in African American neighborhoods.

In support of the City of Philadelphia’s Plan to Affirmatively Further Fair Housing, PolicyMap added data on racially and ethnically concentrated areas of poverty along with HUD’s seven Opportunity Indices. Making these data available supports Philadelphia’s efforts to design and implement actions to actively overcome historic patterns of segregation.

Putting data into practice

We combine data and policy research with targeted capital to address entrenched problems.

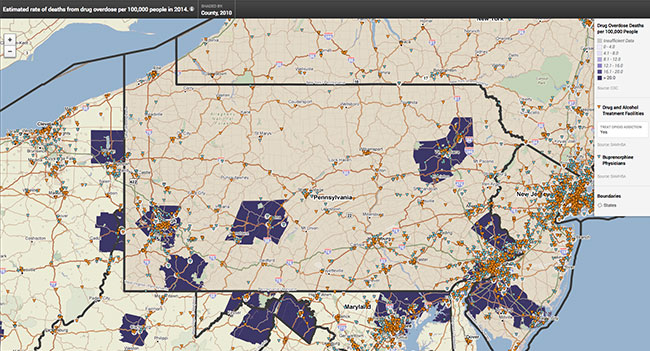

Elevating opioid epidemic awareness

PolicyMap has developed an interactive web mapping tool that helps USDA’s Rural Housing Service identify areas in greatest need of transitional housing to combat opioid addiction.

PolicyMap’s partnership with the USDA’s Rural Housing Service will help the department answer its most pressing policy questions. Through PolicyMap, it now has all of its data in one place, accessible through a robust and user-friendly tool. PolicyMap makes the data accessible at USDA headquarters and field offices throughout all 50 states and the territories. The agency can instantly generate internal reports on any area, and PolicyMap will allow it to streamline tracking and program evaluation.

USDA’s rural housing investment data is also being released to the public as part of a department-wide effort to become more transparent in order to facilitate more effective collaboration with USDA’s stakeholders, partners, and lawmakers to address rural community needs nationwide.

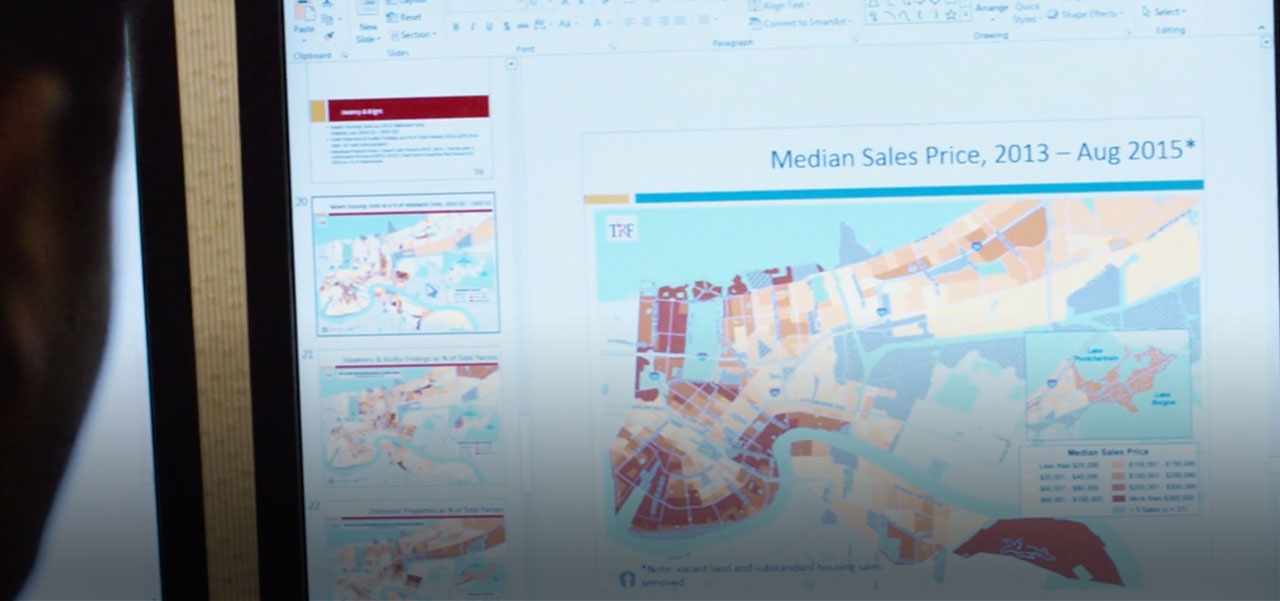

Market Value Analysis, a toolbox for cities

Reinvestment Fund is working with city and municipal governments nationwide to improve the use of data in how community development resources are directed into neighborhoods. At our inaugural Community of Practice convening in Milwaukee, 40 senior administrators and city officials gathered to discuss challenges and success stories, and how Reinvestment Fund’s Market Value Analysis can help cities visualize their market strengths and weaknesses to achieve their goals. The conversation that began in Milwaukee is ongoing—we have launched an online forum where this practitioner network continues to engage with us and their peers as they work through how to use their data to chart a redevelopment path.

In 2016, we completed several MVAs including analysis for Kansas City, Missouri; Indianapolis, Indiana; and Selma, Alabama.

Access to quality early learning

Reinvestment Fund received a $15 million grant from the William Penn Foundation and $3 million grant from Vanguard Strong Start for Kids Program™ to expand the Fund for Quality, a joint project with Public Health Management Corporation that has created 1,000+ high-quality early childhood education seats for low-income children.

This funding will help create an additional 1,400 seats by 2020, giving thousands more children from low-income families across Philadelphia access to quality early learning opportunities.

Also critical to the success of Fund for Quality is another joint project, Philadelphia Childcare Map, based on our research into the gaps in the supply of and demand for quality early childhood education in neighborhoods across the city. Reinvestment Fund has replicated this analysis for Newark, NJ, and Passaic County in NJ. The analysis is also being done for Atlanta, GA.

Middle neighborhoods in America’s legacy cities

Legend goes that when notorious bank robber Willie Sutton was asked why he robbed banks, he said, “because that’s where the money is.” When asked why we should be concerned with the middle neighborhoods of our legacy cities, one practitioner said, “because that’s where the people are.”

With support from JPMorgan Chase Foundation, Reinvestment Fund authored a chapter on the demographics and characteristics of middle neighborhoods in legacy cities for the Federal Reserve Bank of San Francisco’s Community Development Investment Review.

Legacy cities represent a unique subset of American cities because they have struggled to manage a severe loss of manufacturing jobs and experienced significant population loss. Legacy cities like Detroit, St. Louis, Pittsburgh, Baltimore, and Philadelphia have seen their populations decline since their 1950s peaks. Across each of the studied cities, middle neighborhoods have generally advantageous levels of income and education, are demographically and economically diverse, and are home to the largest portion of their cities’ population. In an environment of limited resources, community development leaders are challenged to rediscover the value and the importance of middle neighborhoods.