Research & Data

Market Value Analysis

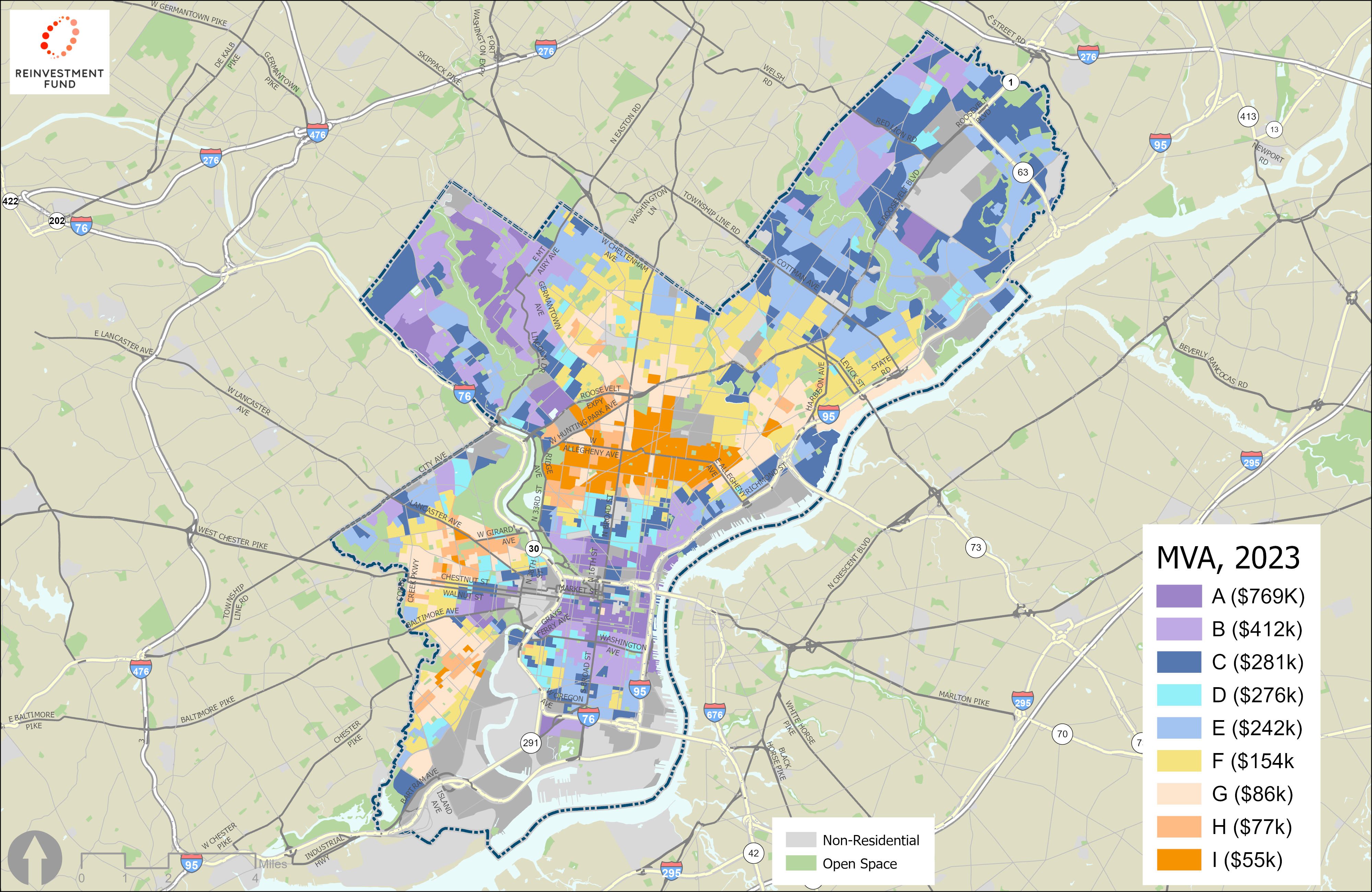

Our most effective tool for guiding neighborhood investment strategies, the Market Value Analysis (MVA) uses smart data to tailor strategies to community context.

About the MVA

The MVA is a data-based, field-validated examination of a city or region’s residential real estate market informed by local stakeholders. Completed principally with administrative data reflective of the housing market (e.g., home sales, building permitting, vacant properties, subsidized rentals, etc.), the MVA is used by localities across the country to make data-based investment and programmatic decisions. The MVA is also used to understand how certain phenomena, such as racial integration or mortgage denial rates, differ by sub-market type.

The MVA is a tool to inform community revitalization and manage neighborhood change; it identifies different types of residential markets, and those places where strategic intervention can stimulate private market activity or capitalize on larger trends. It is a unique approach using spatial and statistical analysis to create an internally-referenced index of residential real estate markets.

The MVA provides stakeholders with a common understanding of market types that allows public, nonprofit, and community organizations to engage in productive dialogue around the creation of a coordinated investment and service-delivery strategy. The MVA also provides a baseline against which community change over time can be measured. We have completed over 40 MVAs for city, county and state governments including Philadelphia and Pittsburgh, PA; New Orleans, LA; Kansas City, MO; Jacksonville, FL; and the state of Delaware.

Explore Our Analysis

Each MVA is unique. While many studies compare neighborhoods to neighborhoods, the MVA analyzes conditions at the Census block group level. Our experience in cities across the U.S. is that conditions vary significantly within neighborhoods. By looking below traditional neighborhood boundaries, the MVA can highlight market challenges and critical nodes of strength to inform investment strategies.