Capitalizing Child Care

Access to quality early childhood education programs is critical to the broader economy as it allows parents and guardians to work and earn, while giving children the foundational skills to succeed in life. A 2018 study by GEEARS and the Metro Atlanta Chamber found child care challenges led to at least $1.75 billion in losses in economic activity annually and an additional $105 million in lost tax revenue for Georgia.

The COVID-19 pandemic has only further illuminated child care challenges. As the nation moves from stabilization to recovery, more attention is being paid to the fragility of the child care system, in particular the tenuous operating model and the high cost of building and maintaining a high-quality supply of child care that meets the needs of families. A fundamental need if we are to create a thriving child care sector, is access to capital.

So what does the current child care capital infrastructure look like? A new study by Reinvestment Fund for the National Children’s Facilities Network (NCFN) sheds light on access to capital in the child care industry and the community ecosystem that is necessary to support a thriving sector.

The study analyzed three major sources of funding for child care businesses: Small Business Administration (SBA) loan programs, Community Development Financial Institutions (CDFIs), and philanthropic support from foundations. The findings point to major gaps in the nation’s financial infrastructure and the significant challenges that child care providers face when they seek capital for their businesses.

Access to capital is an essential component of small business development in every sector, and child care is no exception. Startups and young businesses need capital to purchase the equipment and supplies that will make their businesses viable. Established businesses looking to grow also need capital to fund their expansions into new markets or develop the products and services that can fuel their growth. Even businesses not focused on expansion need capital for more mundane but essential activities like paying operating expenses, managing cashflow, refinancing debt, and replacing or repairing physical assets. National surveys of entrepreneurs find that between 90% and 95% of entrepreneurs required financing to start their businesses.

Most entrepreneurs struggle to raise the capital their businesses need. For the entrepreneurs and small businesses working in the child care industry, the challenges financing startup and growth are magnified.

For one, nearly half of center-based child care programs are nonprofits or affiliated with schools or other government entities, making them ineligible for federal small business lending programs. For businesses that can apply for small business or traditional bank loans, the economics of the child care industry make it difficult for entrepreneurs to satisfy traditional underwriting criteria.

Child care is a highly regulated industry with low margins and high fixed costs. Because many families are limited in what they can afford to pay and government subsidies do not cover the full cost of care, most programs operate with margins that barely cover their costs and limited reserves. A study of the finances of providers in Pennsylvania, for example, found that the average child care provider had cash reserves for just five weeks of operating expenses.

On top of these challenges, many of the entrepreneurs running child care businesses face additional barriers to credit. A disproportionate share of entrepreneurs working in child care are women of color, a group that has historically faced the double disadvantage of gender and racial bias that limits access to traditional capital. While all of these factors make it challenging for child care businesses to access the kinds of financing they need, urgent capital needs and facilities improvements mount. States require child care facilities to meet rigorous and often expensive health and safety standards. These standards are integral to maintaining quality environments for our youngest children, but also make setting up or expanding a child care business expensive.

This reality was not lost on Atlanta Mayor Andre Dickens, who last month, announced that the City of Atlanta will invest $5 million toward early education services in his State of the City address. As part of his announcement, he also urged the school system to match this commitment and challenged the private sector to raise $10 million to match the public sector’s contribution.

The investment will build on the work of PAACT, a city-wide alliance of public and private partners convened by GEEARS that is collaborating to improve learning, health, and well-being outcomes for Atlanta’s youngest children and their families. Reinvestment Fund is part of PAACT, which in the past two years, has leveraged more than $3 million to provide stabilization grants, capital grants, quality improvement initiatives and scholarships in Atlanta.

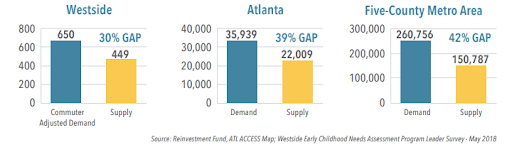

Estimated Supply and Demand on the Westside, Atlanta and Five-County Metro Area based on the 2018 Westside Early Childhood Needs Assessment by School Readiness Consulting.

As the Capitalizing Child Care report points out, child care providers are a strong fit for the mission and focus of many CDFIs and they are not restricted by a child care program’s for-profit or nonprofit status. Communities with the strongest child care sectors are those where stakeholders from the child care, philanthropic, banking, and community finance sectors work together to identify and fill gaps in the availability of resources that child care businesses need.

As a CDFI working in the child care sector, we understand that the financial challenges facing the child care industry are too great for any single organization in the private sector to solve alone. However, by building connections between organizations, we have seen communities achieve amazing results, and we are confident that a similar approach in Atlanta will be successful.

Originally published in the Saporta Report, May 10, 2023