A Call to Action for HBCU Investment

View more stories from our 2022 Annual Report

Reinvestment Fund commissioned a report entitled A Call to Action for HBCU Investment produced by Brookings Metro. The report is part of Reinvestment Fund’s commitment to understanding and meeting the needs of HBCUs as critical institutions in the communities in which they operate.

Reinvestment Fund has served HBCUs since 2018, employing a three-pronged approach:

- convening industry experts and stakeholders to improve cross-sector collaboration.

- committing funding to provide affordable, flexible, mission-driven debt capital; and

- advancing public policy framework to advocate for equitable funding.

In addition to having provided $35 million in investments to strengthen their financial health and fund capital projects, Reinvestment Fund launched the HBCU Brilliance Initiative to raise additional capital from private and philanthropic partners.

We invite leaders, especially those in the financial and philanthropic sectors, to read the report and join us in our efforts to find new ways to better serve these important institutions…

Don Hinkle-Brown, President and CEO

“This report is part of our deepened commitment to improving our support of HBCUs and honoring their goals to improve and expand their financial capabilities, campuses, and their surrounding communities. Brookings has been a great partner and we are pleased to share this call to action as a path forward. We invite leaders, especially those in the financial and philanthropic sectors, to read the report and join us in our efforts to find new ways to better serve these important institutions,” said President and CEO of Reinvestment Fund, Don Hinkle-Brown.

The report is a culmination of a series of cross-sector convenings held by Reinvestment Fund in February 2022. These first-of-a-kind convenings brought together over 30 attendees representing banks, Community Development Financial Institutions (CDFIs), foundations, researchers, and HBCU leaders for a series of conversations on the ways systemic racism has stifled HBCU growth and how the financial and philanthropic sectors can support these learning institutions.

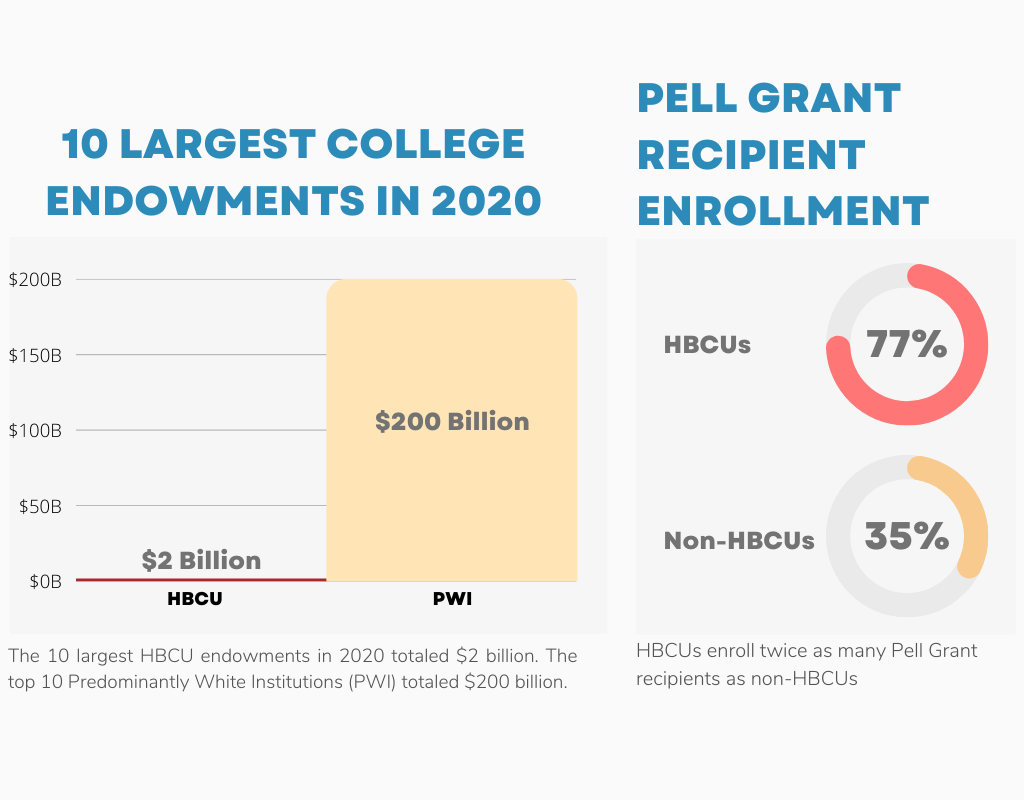

Facilitated by Dr. Andre Perry, these convenings brought to light three key themes that underpin the challenges and opportunities for HBCUs: access to capital, telling the true HBCU story and HBCU capacity building. “That’s why we have so many older, aging facilities on our campuses—because we’ve not been able to generate those types of resources or get those resources in order to continue to create these types of investments needed to grow,” a convening participant explained. These themes helped to guide cross-sector discussions that produced the following six key action steps:

- Build trust and familiarity between CDFIs and HBCUs

- Devise a HBCU-backed theory of change and power

- Translate social and knowledge capital into collateral for capital markets

- Collaborate across sectors in response to challenges and opportunities

- Develop revenue support for students from external projects and development

- Combine balance sheets to lend to a pool of HBCUs versus an individual HBCU

The benefits of investing in HBCUs go beyond the institution and can have a significant positive impact on the surrounding community’s health and well-being.

Yonina Gray, Director of External Relations and Lead for Reinvestment Fund’s HBCU Strategy

As a result of Edward Waters University’s debt refinancing with Reinvestment Fund, the school reported “We were engaging in not only a reinvestment in Edward Waters University, but we were a part of the community. For everything we did as a university, it was building up the community.” This is the principal goal of Reinvestment Fund’s HBCU Brilliance Fund: to support the growth and stabilization of HBCUs and the communities surrounding them through investment and other critical resources, including grant-funded research, policy advocacy and capacity building.

This report magnifies the vital role HBCUs play in accelerating Black economic mobility, among the most marginalized students, and promoting economic growth in their communities and beyond. The call to action highlights how mission-based institutions like Reinvestment Fund can provide capital and capacity building investments to help sustain this critical role. Strong partnerships between HBCUs and financial and philanthropic institutions, particularly CDFIs, are needed to advance the economic mobility of Black Americans and economic strength of our communities.

Reinvestment Fund wishes to thank Dr. Andre Perry, Brookings Metro, UNCF, PNC’s Community development Banking group for their thought leadership, support and insights produced this report.