Reinvestment News Summer 2018

Remembering and Honoring Jeremy Nowak

Jeremy Nowak was a visionary leader, who worked tirelessly for equity in low-income communities. As we grieve the loss of our founder, we share with you a glimpse into his brilliance and what made him one-of-a-kind.

- “Power belongs to the problem solvers”, an excerpt from his new book, The New Localism

- Keynote address at Thrift Week 2012

- Acceptance speech upon receiving the Philadelphia Award in 1995

In honor of his memory, donations can be made to the Mastery Charter Foundation—Jeremy Nowak Scholarship; Lankenau Hospital Fund #5121 for the Cardiothoracic Intensive Care Unit; and Alex’s Lemonade Stand Foundation.

Reverse Mortgages in Philadelphia

From 2009 through 2016, Philadelphia was one of the most active reverse mortgage lending markets in the nation. Older Philadelphians are attractive prospects for reverse mortgage originators because many of them own their homes and are free of mortgage debt. Elderly homeowners who own their homes free and clear are much more common in Philadelphia than in neighboring cities like Baltimore, Boston, and Washington, DC; and like seniors across the country, many retired people in Philadelphia have most of their wealth in their homes.

A new report from Reinvestment Fund examines patterns of reverse mortgage originations in Philadelphia. The report also offers accounts from homeowners, and their heirs, with reverse mortgages that went to foreclosure. The findings reveal that reverse mortgage originations in Philadelphia went disproportionately to predominately African-American communities and were oftentimes for relatively small amounts. For those people that had reverse mortgages going to foreclosure, in-depth interviews with homeowners suggest that the risk of losing one’s home was not understood and that these loans were not used as part of comprehensive retirement planning as reverse mortgage experts have recommended. Because of the costs associated with this product, many of the borrowers were only able to access a fraction of the equity within their home.

Idea >> Action >> Impact

This past year, Reinvestment Fund continued its service of helping low-income communities throughout the country. From expanding early education in Atlanta, to breaking down barriers to employment in Philadelphia, to redeveloping the arts scene in New Orleans, 2017 was a year filled with innovative ideas, hard work, and amazing success.

As you will read in our annual report, we made more than $200 million in loans in 2017—capital that has supported educational opportunities for nearly 5,000 students, over 800 homes, and more than 3,300 permanent jobs. We are proud of the work we have done this past year and are looking forward to continuing our tradition of making an impact on the lives of others in the years to come.

View Our 2017 Annual Report

Increasing Student Housing at Talladega College

Talladega College is a private four-year institution founded in 1867 by the descendants of slaves. A Historically Black College in rural Alabama, Talladega hosts 800 students across a range of liberal arts majors. Over the years, as enrollment has grown, the college has faced a shortage of student housing in its rural community. Reinvestment Fund financing is helping develop a 203-bed student housing building and a student life center that will provide facilities for food and health services. The project was able to secure a USDA guaranteed community facility loan, and through the participation of Reinvestment Fund and other local lenders in a new leverage lending structure, was also able to utilize the New Market Tax Credit financing.

Talladega explicitly seeks to serve a low-income population–98% of its students are Pell Grant eligible and 85% are first generation college students.

Spotlight on Invest Health in Trustee Magazine

Learn about health systems and civic collaborations aimed at helping communities thrive in Invest Health cities. Read the full article.

Preserving Affordable Housing

Reinvestment Fund financing is helping Shift Capital preserve a scattered-site mixed-use portfolio containing 51 residential units and 4 commercial spaces in Philadelphia’s Kensington neighborhood. Kensington has a long history of industrial and commercial activity, and despite decades of disinvestment, the neighborhood remains home to a significant population, largely due to its dense supply of stable, affordable rental housing. A diverse neighborhood, Kensington has a majority (61%) Latino population and almost 60% of households live in poverty. Kensington also faces increased challenges stemming from the growing opioid epidemic.

Although Shift’s primary focus has been reinvesting in larger, industrial properties, it is also committed to preserving and stabilizing the neighborhood’s housing stock and commercial amenities. The homes, which are all for rent, have undergone renovations to assure their ongoing quality and affordability to low-income tenants.

Support Our Work as an Investor

Reinvestment Fund is pleased to share the newest prospectus on our Promissory Note program. Learn more about how to become an investor and support neighborhood revitalization.

Understanding Social Need in Communities

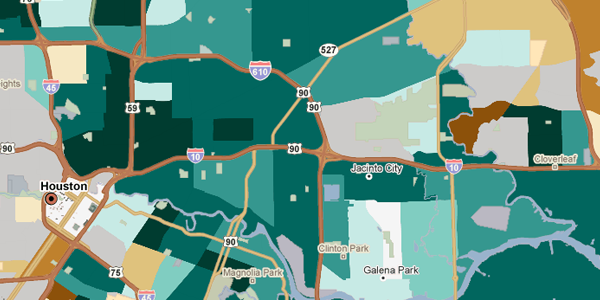

PolicyMap has added a new data layer called the Social Needs Index that combines several indicators commonly used to illustrate social need into a simple 1 to 10 ranking, with 10 being the areas of highest need.

The Social Needs Index was created by the urban research firm New Localism Advisors and shared with PolicyMap to be made available to premium subscribers. Though the index has a wide range of potential uses, it was originally made to help guide investments to Opportunity Zones.

The Social Needs Index incorporates five underlying variables: 1) Population below poverty; 2) Households with rent or mortgages greater than 30% of income; 3) Population not in the labor force; 4) Population with less than a high school degree; and 5) Gini index of concentrated income (a measure of income inequality).

Meet our Summer Interns

Each year, we welcome students to our offices with internship opportunities that help them learn about community development. Meet our interns and see what they have been working on.