A Thriving West Philadelphia Childcare Business is a Case Study on Expanding High-Quality Care

View more stories from our 2021 Annual Report

Pee Wee Prep—owned and led by Dr. Stacy Gil-Phillips—has been a staple, high-quality childcare center in West Philadelphia for 30 years. In 2021, Pee Wee Prep received a grant from Reinvestment Fund’s Fund for Quality (FFQ) program to support the construction of a new facility. That same year, the center also received a bridge loan from Reinvestment Fund to support the costs of adding PHL Pre-K program slots at their existing locations.

For Stacy Phillips, the journey to becoming an early childhood education provider began in 1991 when she struggled to find a quality childcare center for her newborn twins. After a bad day-care experience, she decided to leave her career in corporate America to open her own program at the local rec-center. Originally, it was a short-term project, but after realizing that she wasn’t the only parent struggling to find reliable care, early childhood education transformed into a passion for the West Philly native. Gradually, Phillips grew Pee Wee Prep (PWP) to span three locations, with a fourth, multi-purpose center, currently under renovation. The growth has enabled PWP to serve more children, many of whom attend the center as a part of the City’s PHLPreK program.

Multiple facilities and thousands of PWP graduates later— the business has been a critical force in making safe, high-quality childcare more accessible within the community. PWP’s four centers are in a 6-10 block radius of West Philadelphia and serve over 200 local children annually. Serving a diverse population of primarily low-income families, Phillips has expanded over the years to meet several of the community’s needs. The center has a unique “one-stop shop” method that provides childcare services for infants and toddlers, after-school programs for school-age children, and even counselling and workshops for parents.

Investing in high-quality care

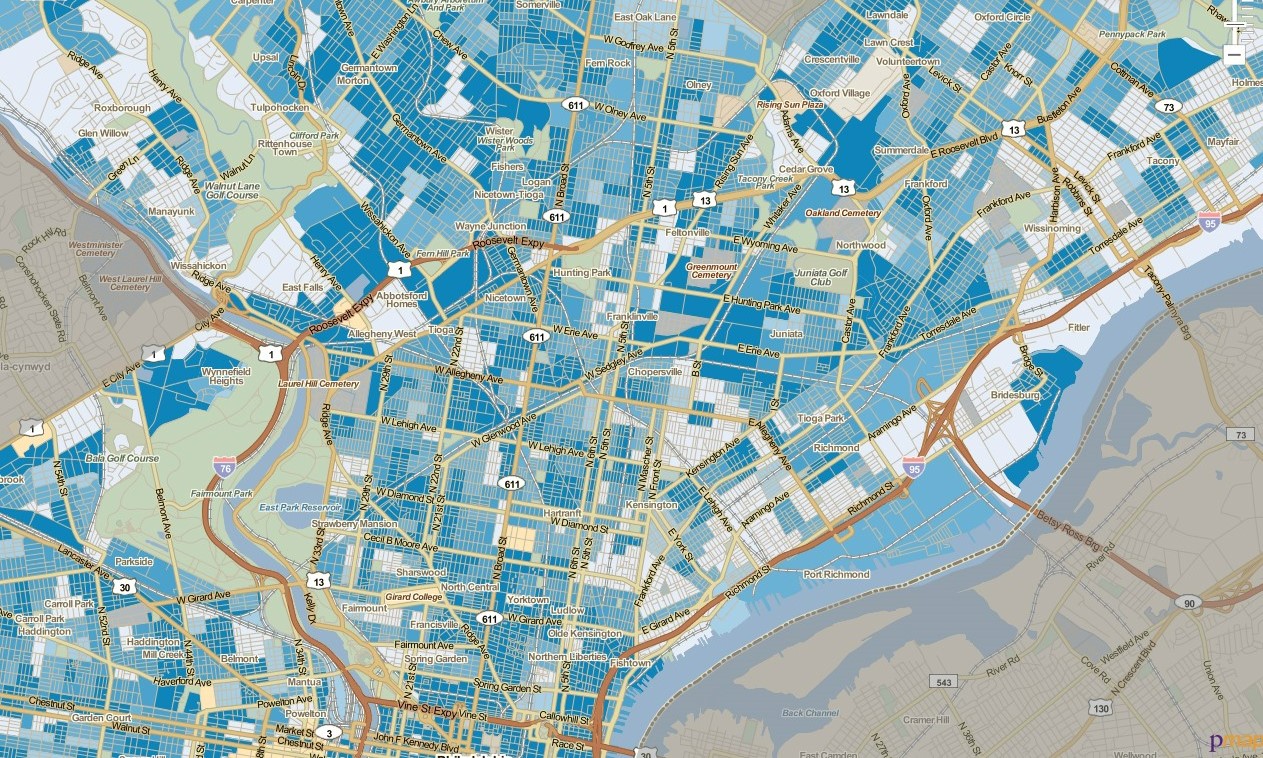

Phillips and her husband are from West Philadelphia—it’s where their heart is and it’s where they wanted to build their childcare business. Part of her motivation is to make a difference in the community that hasn’t had the same opportunities to create quality care centers as neighboring ones. “We know that there are high-quality day-care centers on the other side of City Line Avenue, in the University of Penn area,” she explains. “But when you come into our neighborhood you struggle to find high-quality day-care centers that can pull the funding from places, like the City, to help them raise their level of quality.”

Our research shows that disparities in quality childcare access isn’t just a West Philly or Philadelphia problem, it’s a national problem. The solution is greater collaboration between the government, philanthropic, community finance, and banking sectors.

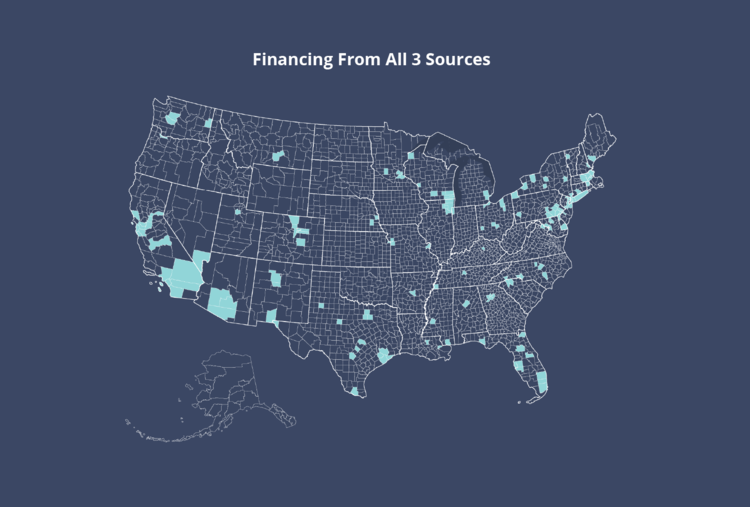

Whether capital is for purchasing equipment and supplies, expansion into new markets, or more mundane but essential activities like paying operating expenses and managing cashflow—all small businesses need access to capital to be sustainable, and childcare is no exception. One of the largest challenges in childcare is the lack of adequate funding in the sector. Reinvestment Fund’s research found that communities with the strongest childcare sectors are those where stakeholders from the childcare, philanthropic, banking, and community finance sectors work together to identify and fill gaps in the availability of resources that childcare businesses need. Unfortunately, in many communities, such a thriving ecosystem simply does not exist. In fact, our research found that only 166 of the 3,142 counties in the U.S. have SBA lending, CDFI lending, and philanthropic activity working at sufficient levels to effectively support childcare businesses.

A Bridge Loan Enables Additional PHLpreK Slots

Philadelphia is a case in point that demonstrates a growing childcare funding ecosystem. For example, PWP has participated in the City of Philadelphia’s free quality pre-K program, PHLpreK, with 90 slots since the program began in 2016. The City’s PHLpreK provides free seats to children in low-income communities and has helped stabilize early childhood education businesses by providing an additional source of revenue.

In 2021, the City awarded PWP 126 slots (a 40% expansion) across two sites, both located in severely distressed census tracts where there is a lack of high-quality seats. Unfortunately, the subsidized funding to support the additional slots and all the costs to prepare for the children’s arrival—added salaries, training for staff, equipment—wouldn’t come through until months later when the school year started. Accessing funding when needed, and quickly, can be among the biggest challenges childcare providers face.

However, this type of gap in contracted funding is exactly where CDFIs, like Reinvestment Fund, can be catalytic. Because of the relationship Phillips built with Reinvestment Fund through her previous Fund for Quality (FFQ) grant, she decided to apply for a bridge loan through the Phila ECE Loan Fund to make sure her facility would be ready to welcome the additional children. “This particular funding source was a blessing because other funding sources such as banks and lines of credits—they require more than what most businesses can provide—especially when you are in a spot where you need to increase your cash flow,” explains Phillips describing how the bridge loan helped her prepare for the additional PHLPre-K slots.

PWP’s ability to add more PHLPreK slots was also enabled by a previous grant that supported an expansion of its space. In 2021 amid the pandemic, PWP was awarded a FFQ grant through Reinvestment Fund to finance the complete renovation of a 14,000 sq ft building facility including seven classrooms and a large multi-purpose room. By providing business planning support and facilities-related financing, FFQ supports high-quality early care and education providers expand their services to reach more low-income families. While many organizations focused on relief funds during this time, Reinvestment Fund understood the value of getting this center up and running to accommodate 120 more children in need of childcare. COVID-19 unearthed the substantial gaps in access to childcare and the fragility of the system across the country, but especially for low-income families—many of whom are essential workers. Centers like PWP play an important role in communities—when quality childcare isn’t available to parents, it has a ripple effect on our economy.

On what is different about the funding she’s received from Reinvestment Fund, Philips expounds that beyond the low interest rate and flexibility, working with a CDFI came with significantly less “red tape” and a lot of hands-on technical assistance. As multiple long standing for-profit and non-profit childcare centers face the threat of having to close, Phillips affirms that CDFIs could play an important role in bridging the gaps in funding needed for these institutions to continue serving their communities and delivering quality childcare. She calls Reinvestment Fund’s mission-based model, “a recipe for success”.

Phillips has big plans for the new facility, including inviting local artists to paint original artworks on each of the new classroom walls. Excitement about the project, which will have a grand opening this summer, is evident. The childcare entrepreneur is receiving swarms of feedback about the community-based project they are building and how it will be conducive to the environment, she says, “People are happy that it’s not another bar or fast-food place…and they [the immediate community and some of the other business owners] are happy that it is a minority-owned business because a lot of our businesses in the West Philadelphia area (minority-owned) has dropped dramatically.”

“We know that there are high-quality day-care centers on the other side of City Line Avenue, in the University of Penn area,” she explains. “But when you come into our neighborhood you struggle to find high-quality day-care centers that can pull the funding from places, like the City, to help them raise their level of quality.”

—Stacy Gil-Philips

Perseverance Leads to Success

For Phillips, the opportunity for PWP to raise their game has always been there—parents in need of affordable, quality childcare is abundant within the community. But despite a great track-record and services in high-demand, accessing the necessary capital to support growth hasn’t been simple. Like Phillips, a disproportionate share of entrepreneurs working in childcare are women of color, a group that has historically faced the double disadvantage of gender and racial bias that limits access to traditional capital.

Traditional capital doesn’t always work for the childcare industry, especially in the early stages of business. For childcare centers that can apply for small business or traditional bank loans, the economics of the industry make it difficult for entrepreneurs to satisfy traditional underwriting criteria. Earlier in her career, Phillips encountered more hurdles than anticipated when applying for an SBA loan to expand her services. The process resulted in $10,000 of unrecovered costs to satisfy rigorous loan requirements. Most SBA loans only reach a small segment of the childcare sector —the largest and most established operators who often manage regional or national chains of childcare programs. This leaves most childcare businesses unable to access this type of funding without dipping into their cash reserves to meet the often-expensive health and safety standards needed to qualify. All the while, urgent capital needs, children in need of care, and facilities improvements mount.

Despite setbacks, Phillips wouldn’t let herself be deterred by the obstacles of the financial industry. She explains, “One bank didn’t work out, so I went to the next bank. I was determined to go through the financial industry until someone saw the value that I saw—which is we were a business in play for 29 years at that time, and we are worthy of funding.”

Unlike traditional banks or SBA loans, many CDFIs like Reinvestment Fund, are working to craft training and technical assistance programs that, together with loans, target the specific needs of childcare businesses. The Fund for Quality and ECE Loan Fund are two collaborations that illustrate how different sectors can work together to support high quality childcare.

Today, Phillips is an advocate for this approach, and through her story, she hopes to help other childcare business owners find mission-aligned financial institutions that see their value too.

Phillips’ achievements as an entrepreneur is a success story for the childcare sector and for West Philadelphia, that has historically faced socio-economic barriers to accessing capital. But PWP’s success took perseverance, and Phillips’ story of growth despite a system working against her, can shed light on the cross-organizational ecosystem necessary to support a thriving childcare sector—as well as the gaps and barriers that still exist.

FFQ is a partnership between Reinvestment Fund and Public Health Management Corporation (PHMC), supported by funding from the William Penn Foundation and Vanguard Strong Start for Kids Program™. By providing business planning support and facilities-related financing, FFQ supports high-quality early care and education providers with expanding their services to reach more low-income families.

The National Children’s Facilities Network (NCFN) and NCFN Executive Committee Member Reinvestment Fund have undertaken a research project to identify and map the financial institutions and intermediaries that help finance the childcare industry — including the childcare business operations and physical facility spaces. Stakeholders and community leaders can use the mapping tool to identify the sources of capital supporting childcare businesses in their community.